Knowing how to shop online securely makes any consumer’s upcoming holiday season a safe, smooth experience. While people often look up the hottest gifts of the season and ideas for hosting celebrations, far too few research the trending scams and ruses for the holiday or look for online shopping safety tips. Buyers who know the risks of online shopping and how to recognize fake ads, unsecured sites or deals too good to be true are prepared to make purchases online without getting scammed. Shopping online is safe when consumers take proper precautions, so before hitting the checkout button, they should follow these tips for researching sellers, verifying site security and choosing safe payment methods.

Research Online Retailers

Consumers’ safest bet is to stick with stores they already know and trust. But sometimes the best deal might be an offer from an unfamiliar up-and-comer, and many gift-givers love to support little-known local shops. While buyers might be tempted to jump on a deal quickly, researching the seller before checking out can help shoppers stay safe online during the holidays and avoid falling for Internet scams. Before doing business with unknown retailers, online shoppers should:

- Read reviews and ratings to determine a seller’s credibility

- Scrutinize too-good-to-be-true deals and read any fine print

- Verify business contact information

- Be wary of checkout processes that request anything beyond the necessary information

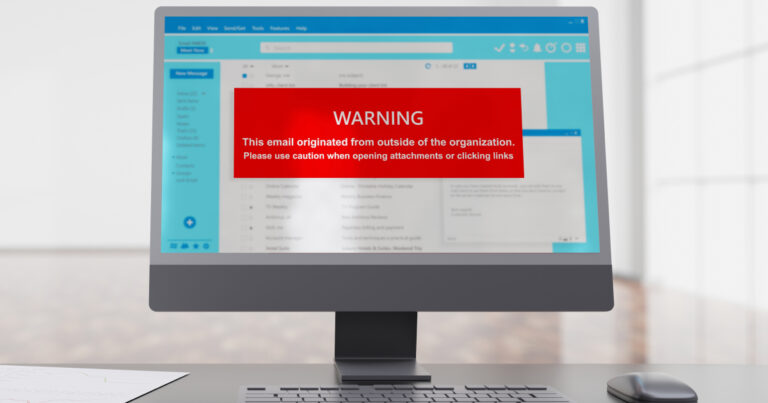

- Approach email or text offers cautiously, especially if they come from unknown sellers

- Read the seller’s delivery, return and refund policies

Shop on Trustworthy, Secure Sites

A site can be considered trustworthy if a shopper’s research raises no red flags and if the site’s security is up to par. Shopping on secure websites is the safest way to make purchases online because information transmitted (e.g., personal information, passwords, payment methods) is encrypted upon submission, reducing the chances a hacker will intercept the data.

Consumers can check a site’s online shopping security by looking for a padlock symbol on the address bar of the browser and verifying the web address includes an “s,” which stands for secure (https://). If there is any question about the legitimacy of the security, internet users can click on the padlock to find additional information. If a site still prompts an uneasy feeling, a shopper’s instincts could be warning him or her to do more research or find a similar product elsewhere.

Use Secure Payment Methods

Credit cards, debit cards and digital wallets are all secure, safe payment methods for shopping online because each encrypts personal information and offers some level of fraud monitoring. But rather than simply leaving it up to the financial institution to catch fraudulent activity, online consumers should take additional measures to improve shopping and payment security:

- Avoid sellers who insist upon checks, money orders or wire transfers because these are often signs of a scam.

- Consider using a credit card instead of a debit card to limit a hacker’s access to the cardholder’s financial accounts.

- Use a card with a low spending limit, which can restrict fraudulent purchase amounts.

- Consider using a digital wallet, like Google Pay, because this service protects buyers’ payment information behind several layers of security.

- Avoid saving financial information on a website; for faster transactions, use a digital wallet, which will bypass the contact forms and submit encrypted information.

Avoid Public Networks and Computers

Whenever possible, consumers should avoid submitting financial information via a shared computer or over a public Wi-Fi connection and instead shop at home on a secure Wi-Fi connection. Public connections can be risky for a couple of reasons. First, signing onto a public network with the name of a nearby retailer, hotel or restaurant does not guarantee the connection is not a malicious entity posing as a recognizable business. Second, even if the public network is provided by a legitimate business, hackers could be scanning its activity and collecting users’ information.

If shopping online on public equipment or networks cannot be avoided, consumers should be extra diligent during and after their session. Before plugging in credit card numbers or passwords, shoppers should be mindful of anyone lurking nearby. Fully logging out of an online account for a store, credit card or email is also critical; simply closing the window or tab is not adequate and could keep the user logged in accidentally. Using unique logins and avoiding obvious passwords can also help keep accounts secure.

Monitor Financial Statements and Purchases

Even after following holiday online shopping safety tips, someone could still fall victim to a scam. That is why careful tracking and monitoring of financial statements is an important last step. Since the holiday season can be a frenzy of buying, it is imperative shoppers find a way to track their online purchases to make sure they are not victims of scams. Whether consumers write down information using pen and paper or save email confirmations or other receipts, having something to verify that charges are correct and items were all delivered can catch a scam before it is too late.

Speed up holiday shopping and keep information secure with fast, reliable internet service from FTC.net. Browse our current promotions to find even more ways to save during the gift-giving season and beyond.